Business Insurance in and around Peoria

Looking for small business insurance coverage?

No funny business here

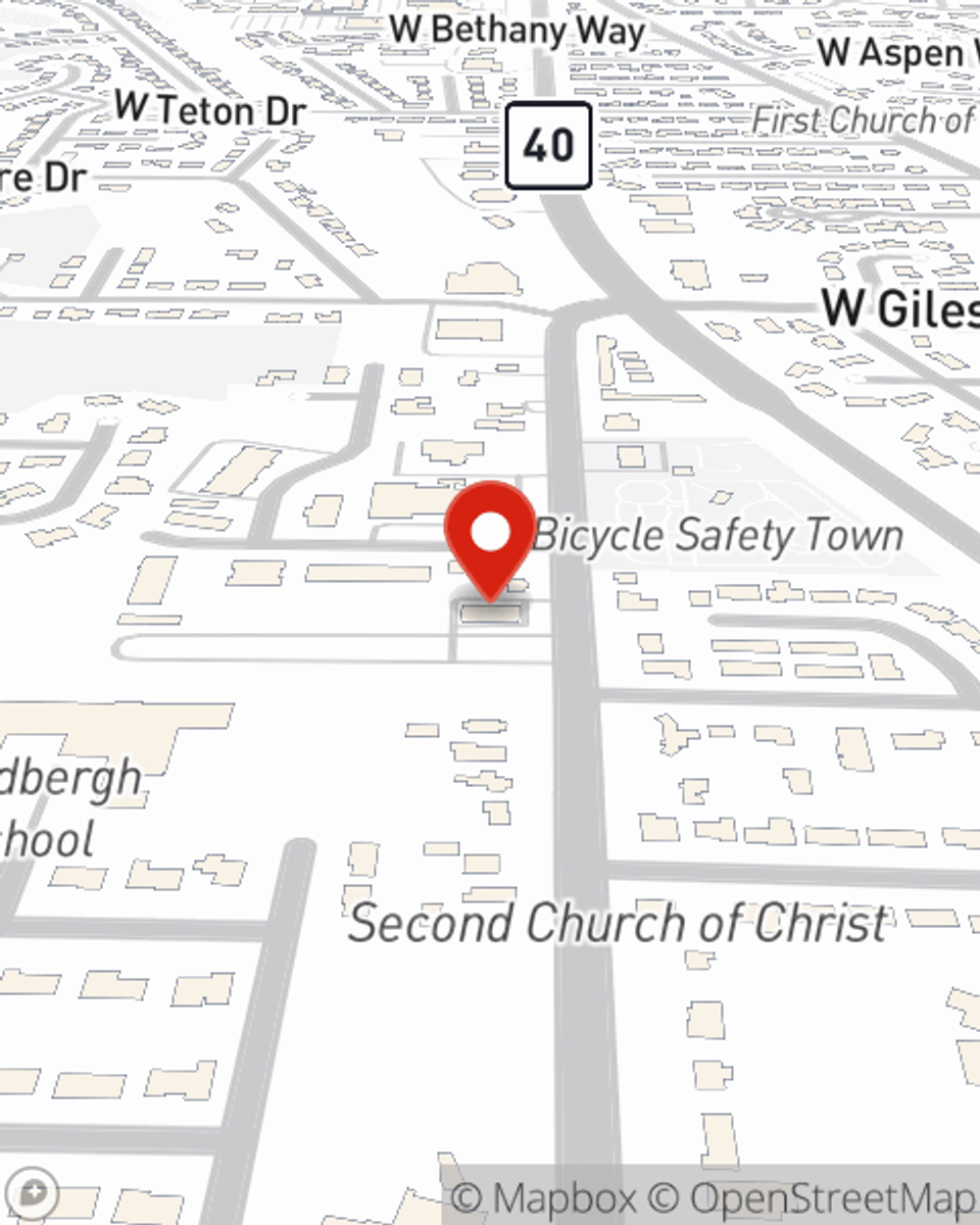

- 6401 N Sheridan Road

Your Search For Excellent Small Business Insurance Ends Now.

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Mark Shipp, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Looking for small business insurance coverage?

No funny business here

Protect Your Business With State Farm

Whether you are a fence contractor an acupuncturist, or you own a fabric store, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Mark Shipp can help you discover coverage that's right for you and your business. Your business policy can cover things such as accounts receivable and business liability.

It's time to contact State Farm agent Mark Shipp. You'll quickly notice why State Farm is the reliable name for small business insurance.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Mark Shipp

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.